Ga payroll calculator 2023

Georgia tax year runs from July 01 the year before to June 30 the current year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

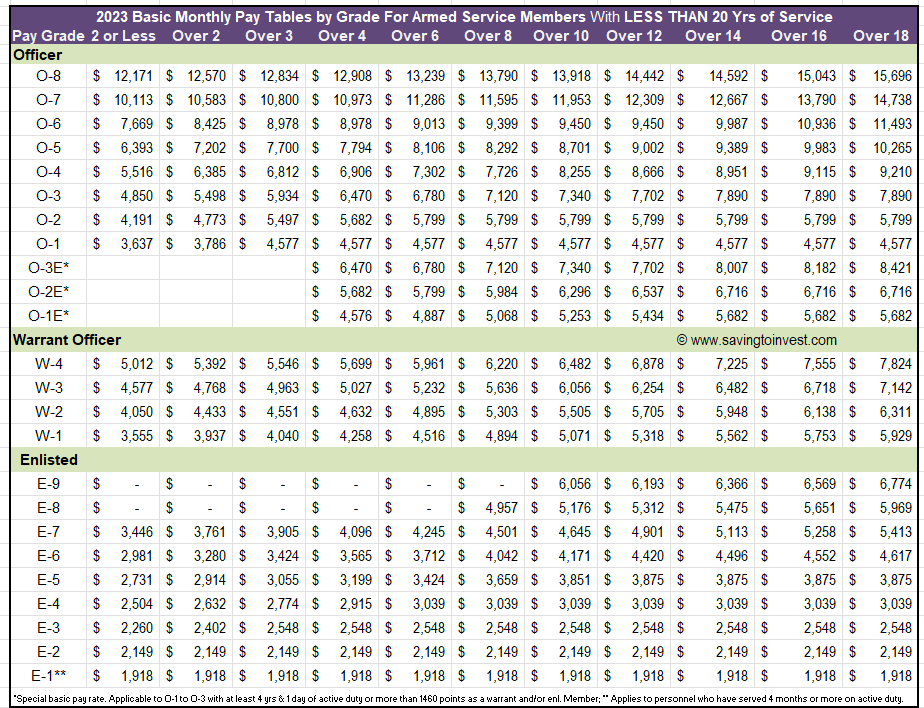

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

For example if an employee earns 1500.

. The standard FUTA tax rate is 6 so your. The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay. Free Unbiased Reviews Top Picks.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. It can also be used to help fill steps 3 and 4 of a W-4 form. Iowa also requires you to.

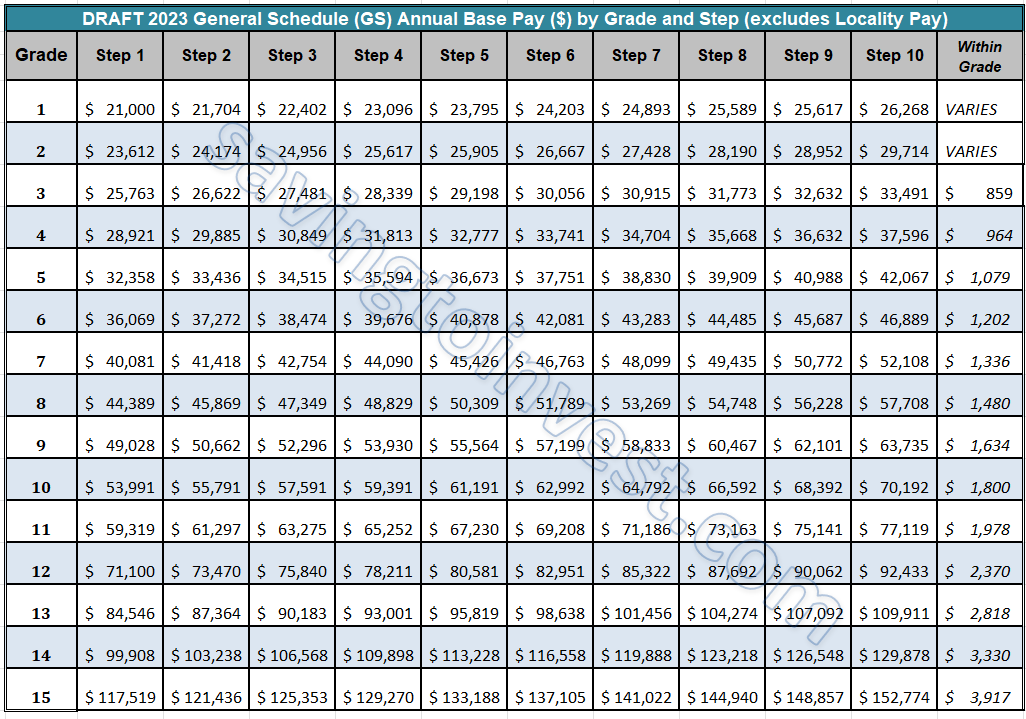

Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first day of the first. Georgia payroll calculator 2023 Tuesday September 6 2022 Edit. Get Started With ADP Payroll.

The yearly base salaries of General Schedule employees in Atlanta can be determined from the 2022 pay chart below based on their GS Grade and Step. Georgia Paycheck Calculator 2022 - 2023. Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax.

Outlook for the 2023 Georgia income tax rate is to. For more details learn more about. Georgia Paycheck Calculator 2022 - 2023.

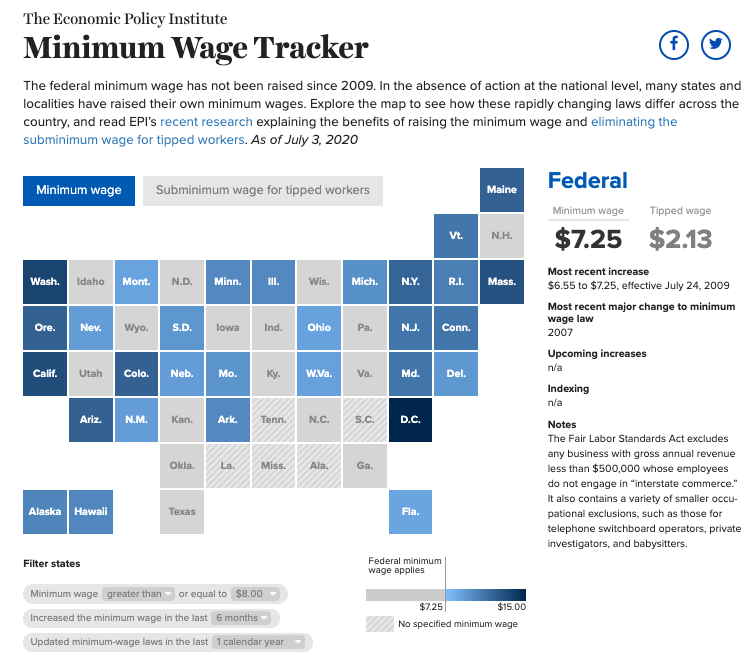

Free Unbiased Reviews Top Picks. Ad Process Payroll Faster Easier With ADP Payroll. For 2022 the minimum wage in Georgia is 725 per hour.

Discover ADP Payroll Benefits Insurance Time Talent HR More. How to calculate annual income. The EX-IV rate will be increased to 176300.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Ad Process Payroll Faster Easier With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself.

All Services Backed by Tax Guarantee. Estimated Income Tax Payments For 2023 And 2024 Pay Online New 2023 Land Rover Range Rover. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV.

Outlook for the 2023 Georgia income tax rate. Calculating your Georgia state. So the tax year 2022 will start from July 01 2021 to June 30 2022.

In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. Employers can enter an. Figure out your filing status work out your adjusted gross income.

Ad Compare This Years Top 5 Free Payroll Software. The first thing you need to know about the Georgia paycheck calculator. Get Started With ADP Payroll.

Get Started With ADP Payroll. Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t-1 t-2 bt-4 t-4 bt-5 t-5 bt-6 bt-7 t-7 fy22 initial years of t-6 creditable. Deadline Calendars 2021 - 2022 Smart HR 2022 - 2023 Smart HR Calculator GO to Calculator Stipend Listings 2021 - 2022 2022 - 2023 2023 - 2024 2024 - 2025 2025 - 2026.

Employers also have to pay a matching 62 tax up to the wage limit. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Ad Compare This Years Top 5 Free Payroll Software.

Georgia State University Holidays 2020 Georgia State University Georgia State State University

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

Cv7fbquq9fbh6m

Eligibility Income Guidelines Georgia Department Of Public Health

Lawmakers Push For 5 1 2023 Federal Pay Raise Fedsmith Com

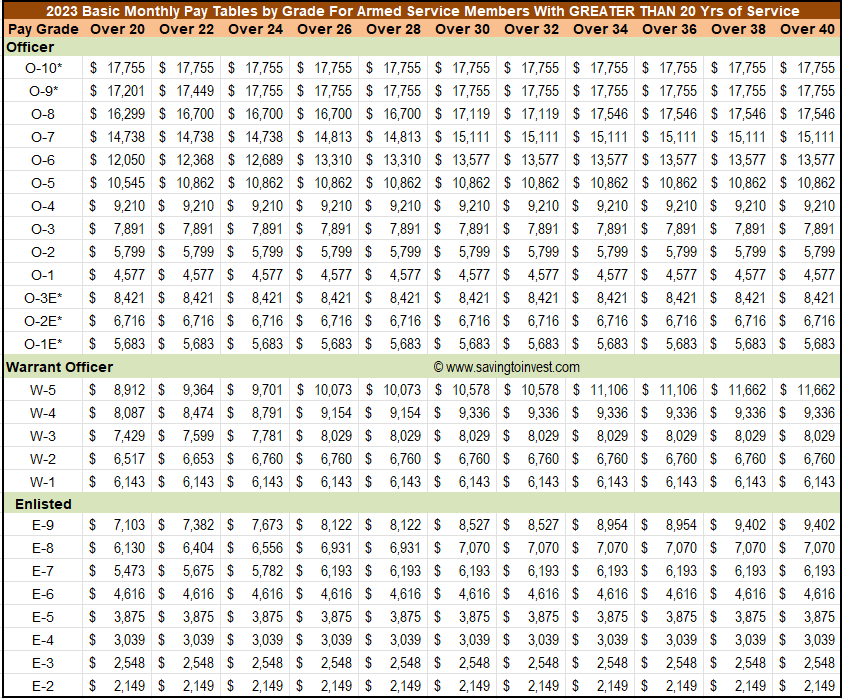

Pay Periods And Pay Dates Student Employment Grand Valley State University

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

2

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

General Schedule Gs Base Pay Scale For 2022

Calculator And Estimator For 2023 Returns W 4 During 2022

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

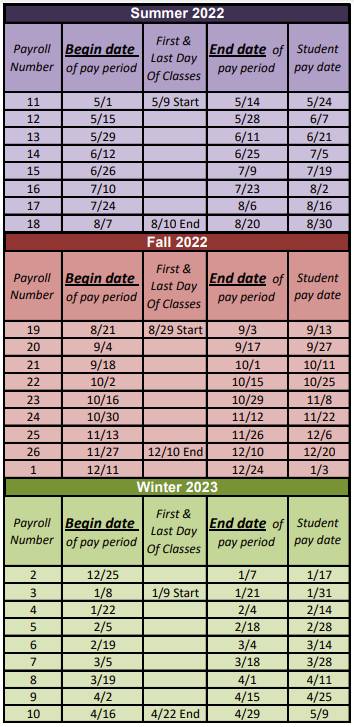

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

Companies Plan To Give Big Raises In 2023 Amid Inflation Money

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Minimum Wage Tracker Economic Policy Institute