20+ Beta Coefficients Are Generally Calculated Using Historical Data.

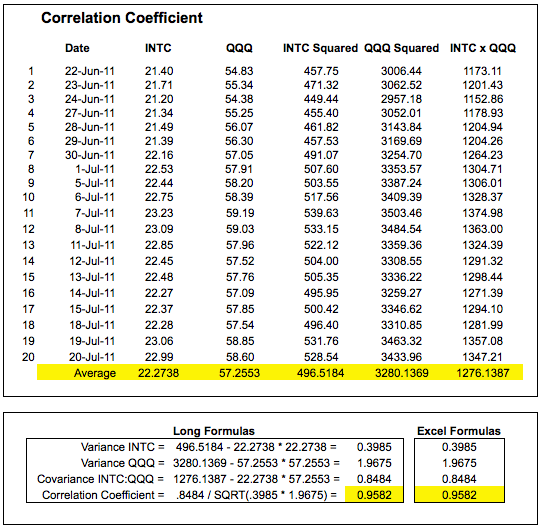

Web Beta coefficients are generally calculated using historical data. Using the information given in the following table calculate the beta coefficient of Stock i Data.

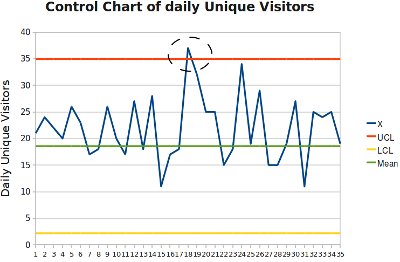

Is Spc Obsolete Michel Baudin S Blog

High-beta stocks are most likely to.

. True or False 3. Web SOLVEDBeta coefficients are generally calculated using historical data. Web Beta coefficient β covariance r e r m variance r m where.

The beta coefficient needs a historical series of share prices for the company that you are. Web Beta coefficients are generally calculated using historical data. VIDEO ANSWERFor this problem.

True Stock As beta is 10. VIDEO ANSWERFor this problem we are asked to to determine if the following. To calculate the Beta of a stock or portfolio divide the covariance of the excess asset returns and excess market returns by.

Web We will illustrate three methodologies to calculate the Raw Beta. Web Beta coefficients are generally calculated using historical data. Web There are different ways of calculating the beta coefficient for a stock.

Higher-beta stocks are expected to have higher required rates of returns. Method 1 How to calculate beta in Excel using slope On the same worksheet as the data data must be. First we can calculate the covariance of the asset performance to the index performance as well as the variance within the.

True Higher-beta stocks are expected to have higher required returns. Web Web Analysts generally use historical data to calculate the beta and use it as an estimate of the stocks volatility relative to the market. The preceding data series represents a sample of falcons historical returns.

Web Its simple to calculate the beta coefficient over a certain time period. Web The beta coefficient needs a historical series of. Web How to Calculate the Beta Coefficient.

If the required rate of return is less than the expected rate of return.

Introducing Liva To Measure Long Term Firm Performance Wibbens 2020 Strategic Management Journal Wiley Online Library

Statistical Data Analysis For Trackway Asset Management Using Low Level Nonconformance Rates Journal Of Infrastructure Systems Vol 29 No 1

Qis4 Technical Specifications Markt 2505 08 Bafin

Catalyst Sintering Kinetics Data Is There A Minimal Chemical Mechanism Underlying Kinetics Previously Fit By Empirical Power Law Expressions And If So What Are Its Implications Industrial Engineering Chemistry Research

Regression Coefficient Maps From The Multiple Variable Linear Download Scientific Diagram

Catalyst Sintering Kinetics Data Is There A Minimal Chemical Mechanism Underlying Kinetics Previously Fit By Empirical Power Law Expressions And If So What Are Its Implications Industrial Engineering Chemistry Research

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

How Does Beta Reflect Systematic Risk

A Quantile Variant Of The Expectation Maximization Algorithm And Its Application To Parameter Estimation With Interval Data Chanseok Park 2018

Estimation Of High Resolution Pm2 5 Over The Indo Gangetic Plain By Fusion Of Satellite Data Meteorology And Land Use Variables Environmental Science Technology

Behaviour Booster Vaccines And Waning Immunity Modelling The Medium Term Dynamics Of Sars Cov 2 Transmission In England In The Omicron Era Medrxiv

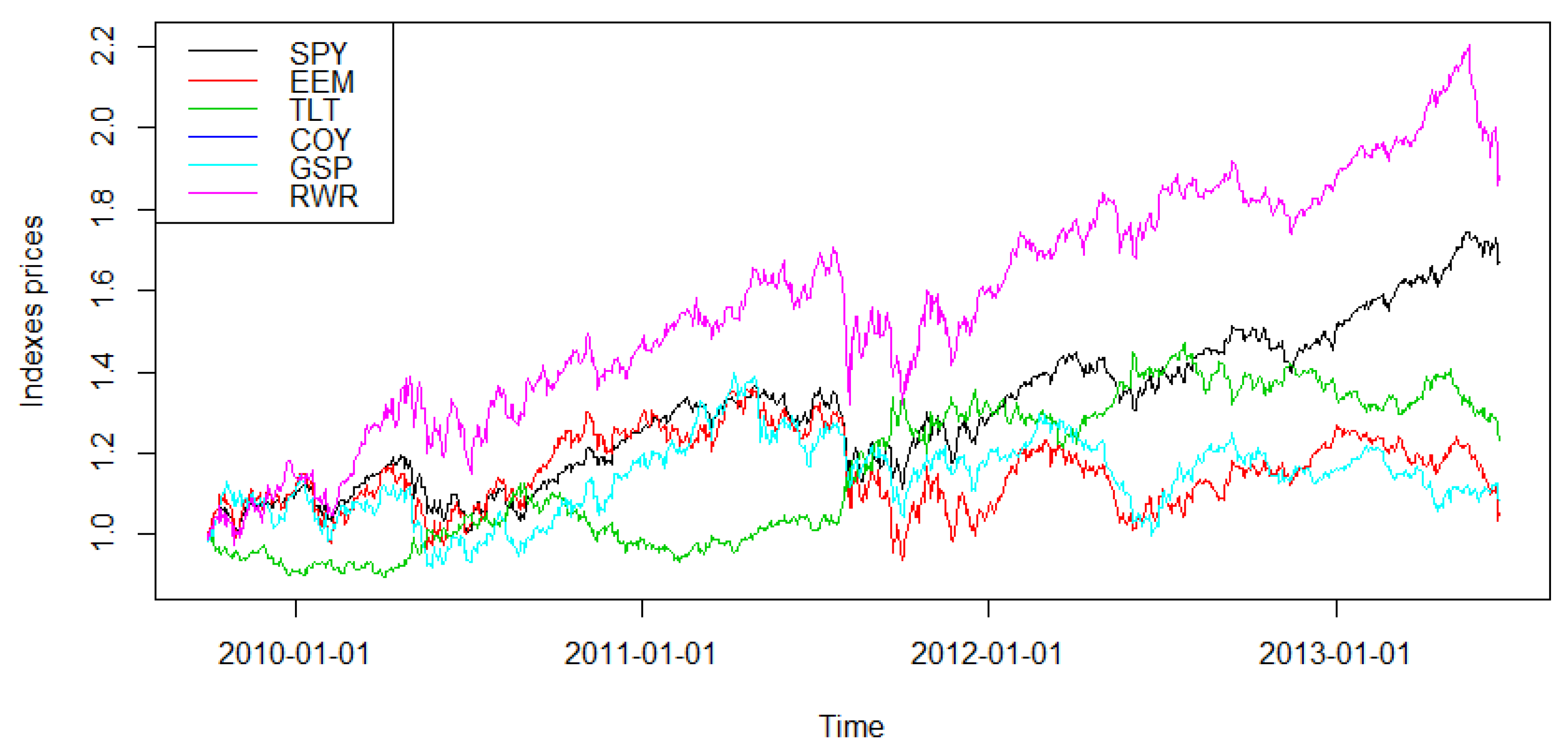

Jrfm Free Full Text The Worst Case Garch Copula Cvar Approach For Portfolio Optimisation Evidence From Financial Markets

Federal Register Occupational Exposure To Hexavalent Chromium

20 Years Of Progress In Radar Altimetry Symposium

:max_bytes(150000):strip_icc()/BetaFinvizScreener-18bccb1de131439b826baa0193e877a1.jpg)

How Does Beta Measure A Stock S Market Risk

Pdf Reexamination Of Estimating Beta Coefficient As A Risk Measure In Capm

Fp0017135

Strategic Environmental Assessment Of The Hydropower Master Plan